If you have been paying attention to Finance news, you are more likely to be seeing this ‘alphabet soup’ SBF. FTX. FTT. Maybe even CZ.

Confused? Let me break it down for you in simple terms.

The short story in layman’s terms is about Crypto tycoon, Sam Bankman-Fried, and the company he founded FTX imploded dramatically causing him to lose 94% of his net worth and CEO position. Consequently, his company filed for bankruptcy.

But there’s a lot more to the saga. Here is exactly what happened.

Who is Sam Bankman-Fried and what is FTX?

Sam Bankman-Fried also known as SBF or the king of crypto launched his crypto trading firm Alameda Research in 2017. Two years later, he started his crypto exchange firm, FTX, making him a billionaire and putting him on top of the market. His platform had attractive perks such as low trading fees and advanced options for traders. FTX is based in the Bahamas and Bankman-Fried took pride in bailing out ailing digital asset firms and donating his money to many causes aligned with the Democratic Party.

At his peak, SBF was worth $26 billion but his net worth had dropped to $16 billion before this week. At 30, he had already gotten celebrities such as Tom Brady to hawk FTX to the public and other celebrities who were steadily hopping onto the crypto craze. In September, Tom Brady and Gisele Bündchen appeared in a 20-million-dollar campaign for FTX. In the ad, the two call everyone on their contact list to convince them to join and start trading on the platform. Surprisingly, SBF had also managed to secure the naming rights to the arena where the NBA Miami Heat play.

So, What Exactly Happened?

In early November, the crypto publication CoinDesk released a report that caught the public by surprise. The report scrutinized and called into question how stable SBF’s empire really was. The report also revealed that Alameda Research and FTX were two separate companies. Additionally, Alameda’s assets were tied up in FTT, a coin invented by FTX.

See the media will tell you that FTX nearly collapsed because it faced a liquidity issue. To be honest, this is just a nice way of saying “Customers wanted their money back and when FTX could not give them their money back, all hell broke loose. However, if FTX is an intermediary, should they really have a problem returning people’s funds? Simply put, if you are a middleman, you don’t take customers’ funds and use them, no?

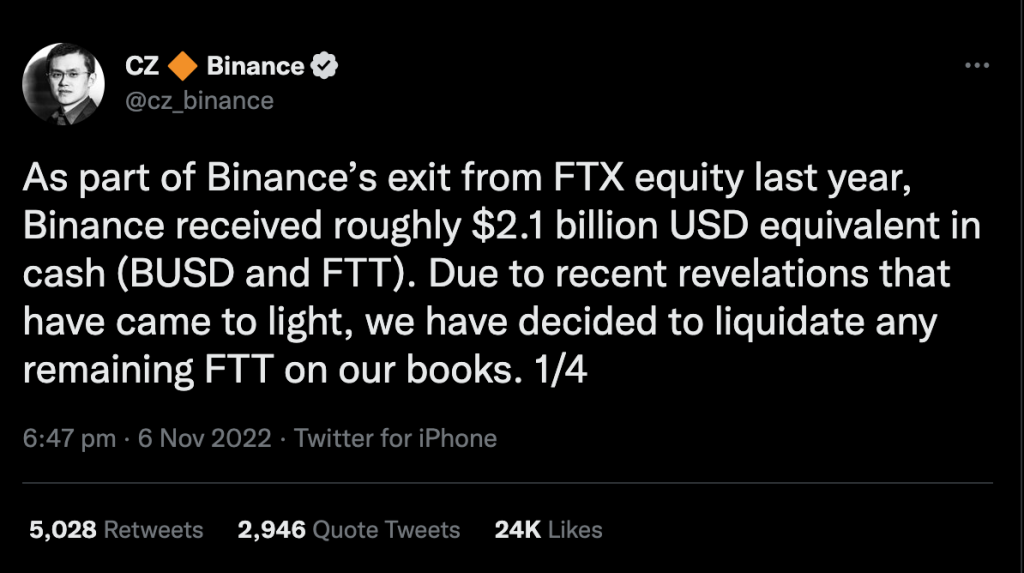

Cue Binance, the world’s largest cryptocurrency exchange. On 6th November 2022, Binance CEO, Zhao set off alarm bells in all investors when he decided to liquidate all of Binance’s holdings of the FTT tokens. Binance had invested as a shareholder in FTX and received $2.1 in Binance’s own stablecoin (BUSD).

In the same post, Zhao expressed that he would no longer support people who stab in the back by supporting other industry players. Many people speculated that the remarks made were a reference to SBF who supported the US Democratic Party politicians and lobbying for the regulation of crypto trading in Washington.

The drama continued with SBF going to Twitter and posting a series of tweets saying that “A competitor is trying to go after us with false rumors.” He added: “FTX is fine. Assets are fine.” He eventually tagged Zhao and tweeted, “I’d love it, @cz_binance if we could work together for the ecosystem.”

On November 8, Zhao decided to liquidate about $530 million worth of FTTs and announced that Binance would buy FTX to which SBF confirmed the same on Twitter. This news led to an estimated $6 billion in withdrawals in 72 hours from their customers which it struggled to fulfill. However, the deal would only be fruitful after proper scrutiny or due diligence was done. Later on, Binance stated that it would no longer push through with the deal citing findings of mishandled customer funds and the likelihood of a federal investigation. SBF later went on Twitter to say that he “fucked up, and should have done better”, casting doubt into FTX’s future.

As a result of the failed deal, the value of FTT plunged even further and 94% of Sam’s net worth was wiped out in one day. SBF tried to call other rivals such as CoinBase for a bailout but nobody came through. Eventually, FTX filed for a level 11 bankruptcy and SBF resigned as CEO.

Does the FTX Collapse Impact Anyone Else?

FTX had high-profile investors such as SoftBank Vision Fund, Tiger Global, Sequoia Capital, and BlackRock. For example, Sequoia had invested $213.5 million in FTX. Other investors, a group of 10 people who lived with Bankman-Fried and help him run the FTX and Alameda from the Bahamas. CoinDesk reported that the group comprised SBF’s college friends and former colleagues. So, it’s highly possible that they are suffering huge losses now.

Well, what if the many allegations that FTX had moved customer funds improperly are true?

What Does This Whole FTX Saga Mean?

Crypto has had a tough year after it suffered a $2 trillion crash in May. The FTX drama has created a ripple effect on the crypto industry which has sent the value of the industry down a further 12%. A lot of people claim that this is about to be another Lehman Brothers moment but for the crypto industry.

This saga might encourage regulators to crack down on the crypto industry or warn banks of people trading in crypto. Even more, the collapse of FTX has made many people lose their faith and confidence in the sector. Consequently, this has led people to withdraw their crypto assets out of fear.

It looks like crypto’s reckoning is coming soon and investors should be wary and stay put. My take is if you are investing in something that might disappear over the weekend, it’s time to ask all the serious questions. Volatility is fine in this market, I mean, even the stock market is volatile. But what makes the stock market and the crypto market different? The prices of crypto are highly dependent on sentiments, beliefs, and statement people make such as “Crypto is the future.” But what happens when these beliefs and sentiments go away?

Where is SBF Now?

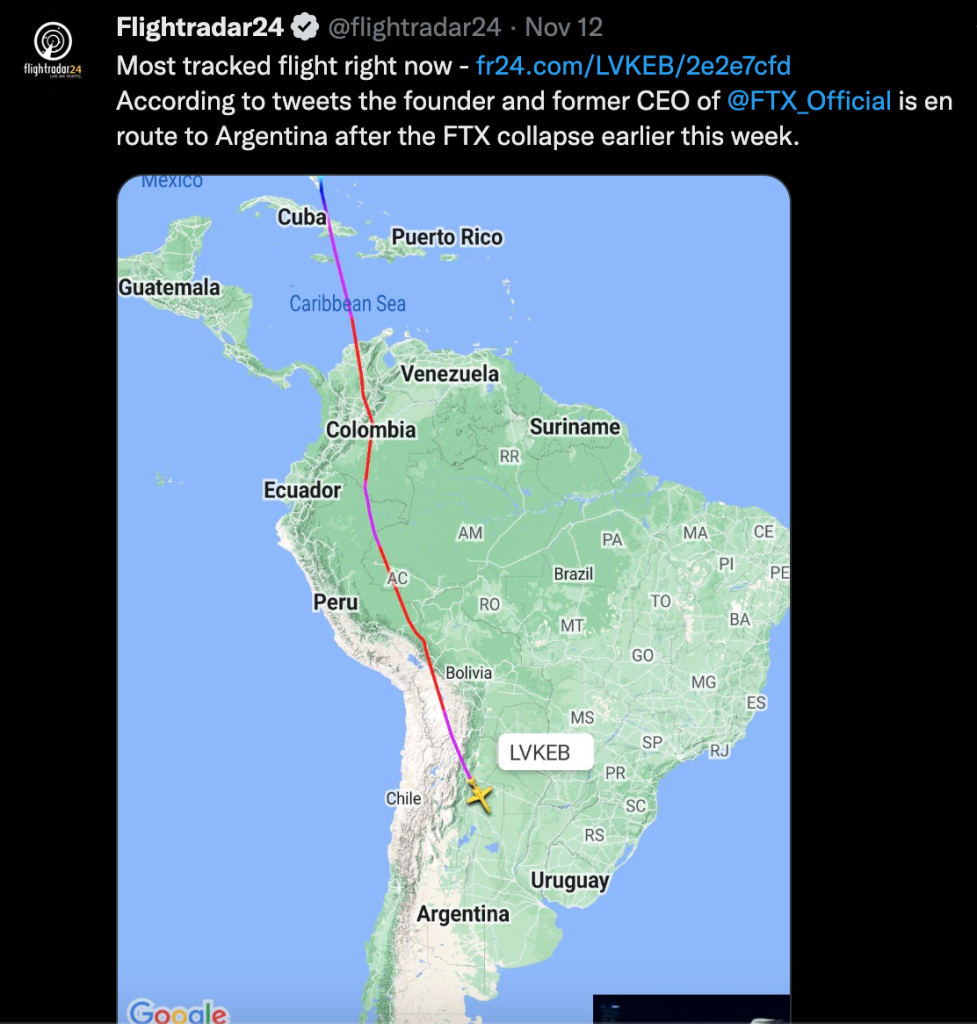

SBF is currently residing in his home in the Bahamas. This is despite claims by FlightRadar24 that he had fled to Argentina.

The former CEO and the other FTX executives are being watched by the Bahamian Authorities. However, CoinTelegraph, a fintech news outlet claims that SBF might be trying to flee to Dubai.

Comments 2