Recently, someone asked me a question, “Where would you invest your money?” Since time immemorial, real estate has been associated with status, affluence, and credibility. Along with gold, it’s one of the best ways to secure one’s wealth.

As we stepped into the modern era, many other investment options came up. Options like stocks, bonds, fixed deposits, mutual funds digital or cryptocurrency gave many investors many choices of where to put their money. However, real estate remains the most secure and beneficial avenue for long-term and profitable investment.

Investing in real estate isn’t just for the rich and famous. Even if you only have a small deposit for a house, anyone can complete it. Anyone can benefit from the profits real estate has to offer with the proper planning and research. Real estate investments are a wise choice if you want to diversify your investments, expand your portfolio, and reap cash flow and financial gains.

So what are the benefits?

Steady Cash Flow

Real estate ownership might increase your monthly income. You can rent out your space to tenants whether you invest in residential or commercial real estate. Rent payments will thereafter be made to you each month.

Cash flow is king! There’s nothing that would give me joy like walking to a mailbox and getting a check that I did not necessarily labor for. Investing in real estate helps create passive income that can create generational wealth. If anything happened and you need money on a rainy day, you have a fallback plan.

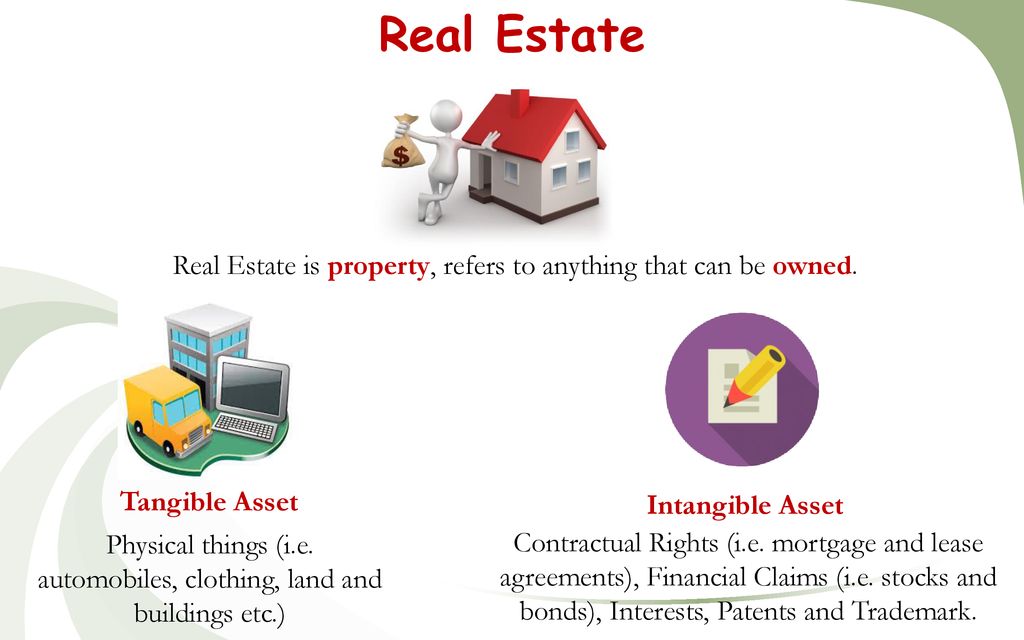

It’s a Tangible Investment

You can see real estate, feel it, inspect it and even improve it. Being a tangible asset, it may be used to profit from a variety of income streams while experiencing capital growth. Its strong tangible asset value, as opposed to other investments like stocks with low or no tangible value, offers perpetual security because its value will never decline.

Real estate has no insurmountable financial challenges and is simple to buy, finance, and improve your lifestyle while offering tax advantages. It’s still one of the best investment opportunities to this day.

Tax Breaks and Deductions

Numerous tax benefits and deductions are available to real estate investors, which can result in financial savings during tax season. The reasonable expenses associated with owning, running, and managing a property are generally deductible.

Additionally, you gain from decades of deductions that assist reduce your taxable income because the cost of purchasing and developing an investment property can be depreciated throughout its useful life (27.5 years for residential properties and 39 years for commercial properties).

Great Retirement Savings Plan

Real estate is not a liquid investment. You make long-term investments in it. You accumulate greater equity in the house over time. You can sell the property when you reach retirement age or just before and utilize the proceeds to fund your retirement.

Renting out the house will allow you to invest in your retirement without making regular monthly contributions because the rent should cover the mortgage payment and other costs. However, talk with your tax advisor before selling your property to minimize your tax liabilities.

Portfolio Diversification

Real estate investing also offers the possibility of diversification. Its correlation with other main asset groups is weak, and occasionally even negative. It follows that using real estate in a portfolio of diversified assets can reduce portfolio volatility and boost return on risk.

Comments 1