Let’s face it-invoicing can be a pain! Invoicing is a crucial step in any business but it’s the most time-consuming process ever. From creating invoices, sending them out, and then following up on unsettled accounts, you might find yourself ‘wasting’ a lot of time. What’s more painful is that invoicing people might cost you a lot without you even realizing it.

Online invoicing is a great alternative to the old systems of sending out invoices. The best invoicing software makes it simple for you to keep track of projects, costs, and invoices and to be paid promptly. They have tools for tracking billable hours and automatically converting quotations into bills. Most companies offer client portals to make it simple to have estimates approved so you can start working and getting paid.

But which online invoice software should you choose, though, with so many options available? To help you decide we reviewed a ton of both free and paid options before choosing them based on their prices, usability, added features, and integration possibilities.

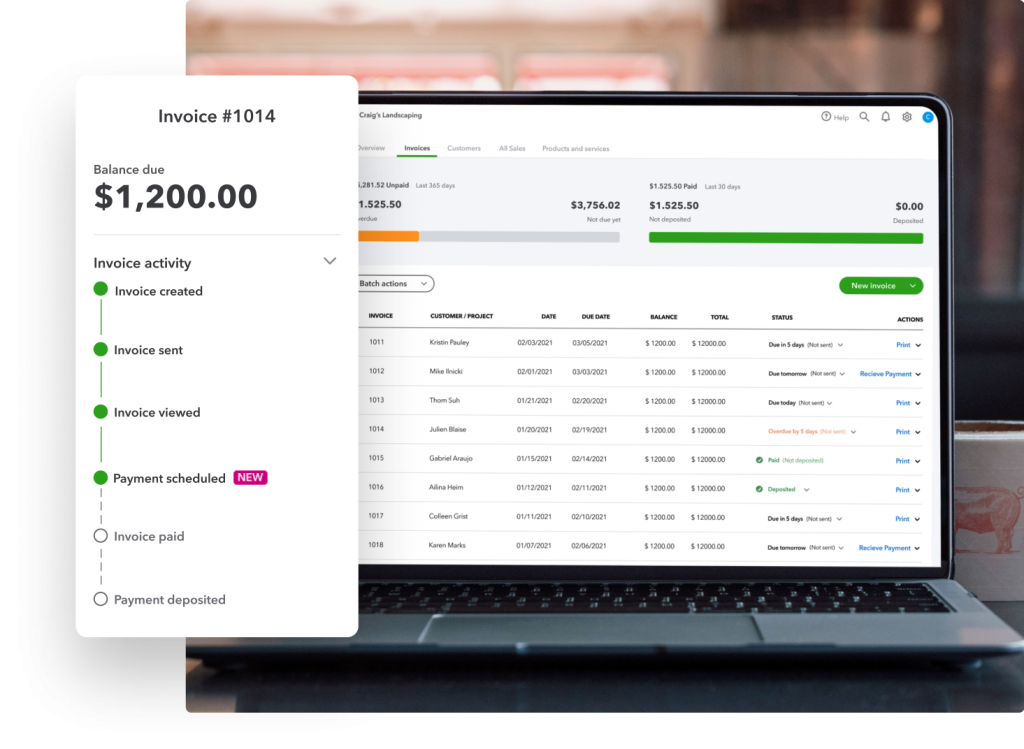

QuickBooks

QuickBooks is a cloud accounting software that is easy to use and helps you organize your finances in one place. It allows you to create and send out custom invoices from any device.

Top Features

- Create & send custom invoices, sales receipts, and estimates

- Track sales, expenses, and profits

- Schedule recurring payments to save time

- Carry out transactions in different currencies

- Track projects

Cons

- No free plan

- Limits on a low-cost plan

Who should use it: Small brick-and-mortar businesses that accept payments online and in person should consider this option. One special aspect of the tax features is the ability to manage 1099 contractors.

Pricing: From $10.36 user/month.

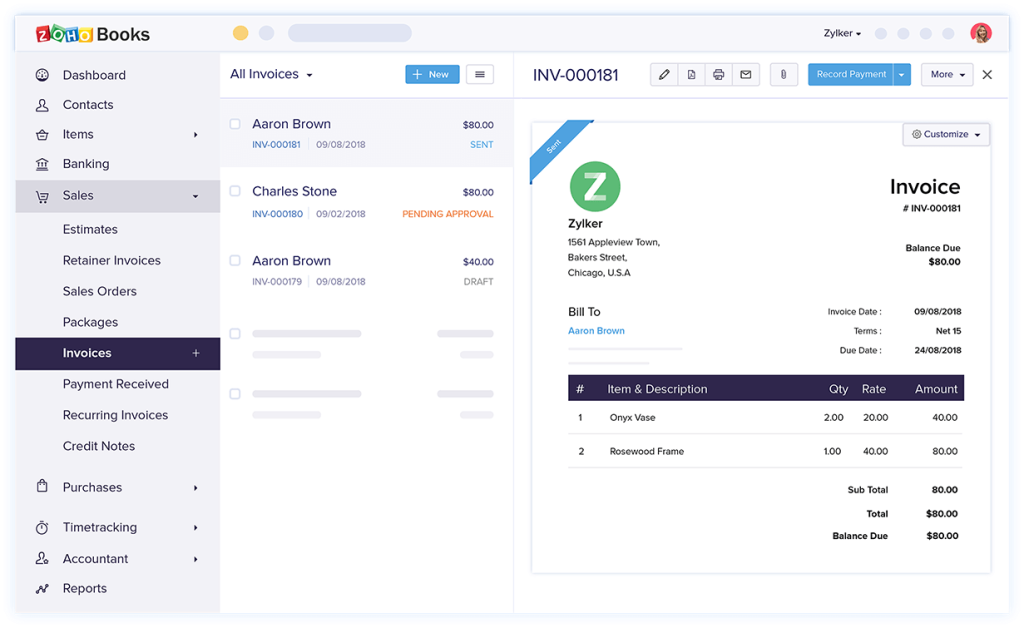

Zoho Invoice

Zoho Invoice is an easy online accounting software that takes care of all the essentials: creating and sending invoices, keeping track of expenditures, syncing bank accounts, generating reports, and doing accounting on the move across all platforms. A great thing about it is that it offers accounting tools that grow with your business.

Top Features

- Track and categorize expenses, and bill them to your clients all from one place.

- It has a free feature

- Has a great project management tool

- Sending professional invoices, setting up recurring invoices automatically, and accepting payments online are all done in an easy, quick, and comfortable manner.

- Get a real-time update on your cash flow by integrating Zoho Invoices with your bank account. Keep an eye on transactions and immediately classify them.

Cons

- Limits users to 5 clients

- No inventory tracking

- One-user limit per account

Who should use it: For a solopreneur who just manages a few clients, Zoho Invoice is perfect. Although you are only permitted to issue 1,000 invoices annually and bill a maximum of five clients, you can track your spending and billable hours for nothing.

Pricing:

- Free: Unlimited invoicing for up to five clients; five automated workflows

- Basic ($9/month): Up to 50 clients; five automated workflows

- Standard Plan ($19/month): Up to 500 clients; 10 automated workflows

- Professional Plan ($29/month): Unlimited client invoicing; 10 automated workflows

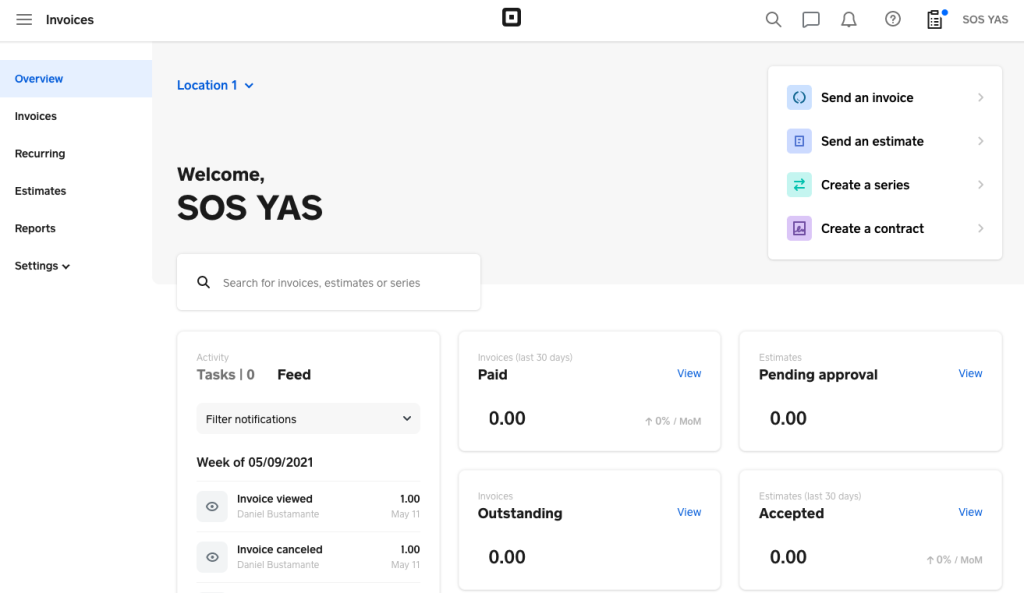

Square Books

Square is known for assisting small businesses in handling both online and point-of-sale transactions. It is the ideal choice for business owners searching for software that does both billing and payment processing because their invoicing services follow the same simplified approach to processing payments.

Top Features

- Real-time invoice tracking

- Unlimited clients

- Integrates with inventory, and time-tracking software

- One-click payment option for customers

- Accept most types of payments

- Includes client portal

- No monthly fee

Cons

- Features like customization, automation, and project tracking only on the paid plan

- Transaction-based fees can add up

- Limited invoice customization

Who should use it: Since it was designed for small enterprises, Square Invoices is adaptable and strong enough to serve expanding companies effectively. All types of businesses, not only service-based ones, can utilize it because it allows them to accept payments from anywhere and connects with other Square apps.

Pricing: It has a free plan and a paid plan of $20 per month.

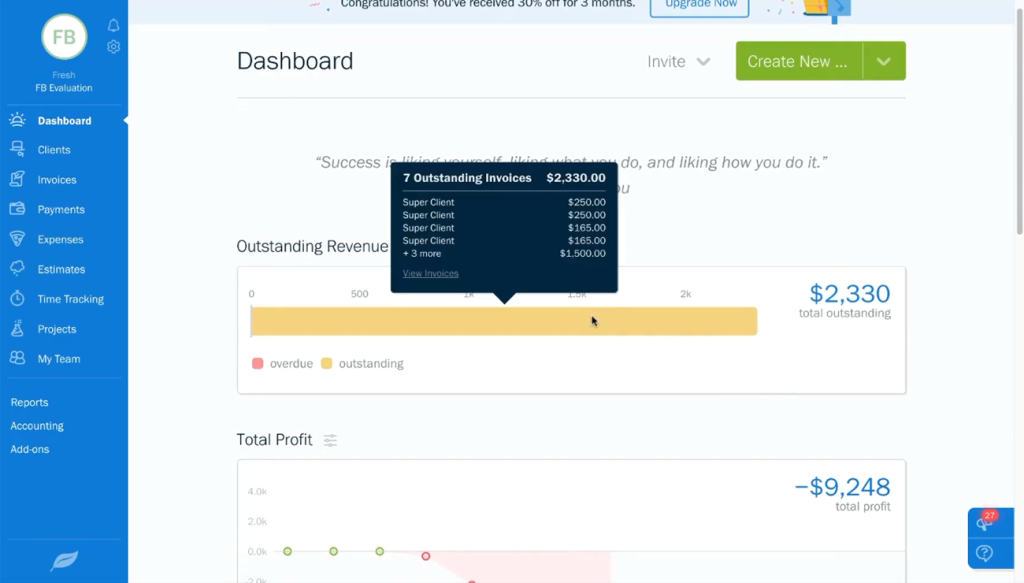

FreshBooks

Freshbooks is a software program that tracks expenses, time, and billing for freelancers and small enterprises.

Top Features

- Customize and send unlimited invoices, including automated recurring invoices.

- Create and send professional-looking estimates.

- See when a client has received, viewed, and paid an invoice.

- Integrates with over 100 apps

- Get business insights with simple reports

- Create automatic late payment reminders and fees.

Cons

- No free plan

- Unlimited clients are available on top-tier plans

- Some features are paid add-ons

Who should use it: Self-employed individuals, freelancers, and small enterprises who require simple invoicing software with accounting functions in more expensive plans.

Pricing: FreshBooks offers a 30-day trial and you can upgrade to any of the following plans if it meets your business plans.

- Lite: $15 per month for five or fewer billable clients

- Plus: $25 per month for six to 50 billable clients

- Premium: $50 per month for 51 to 500 billable clients

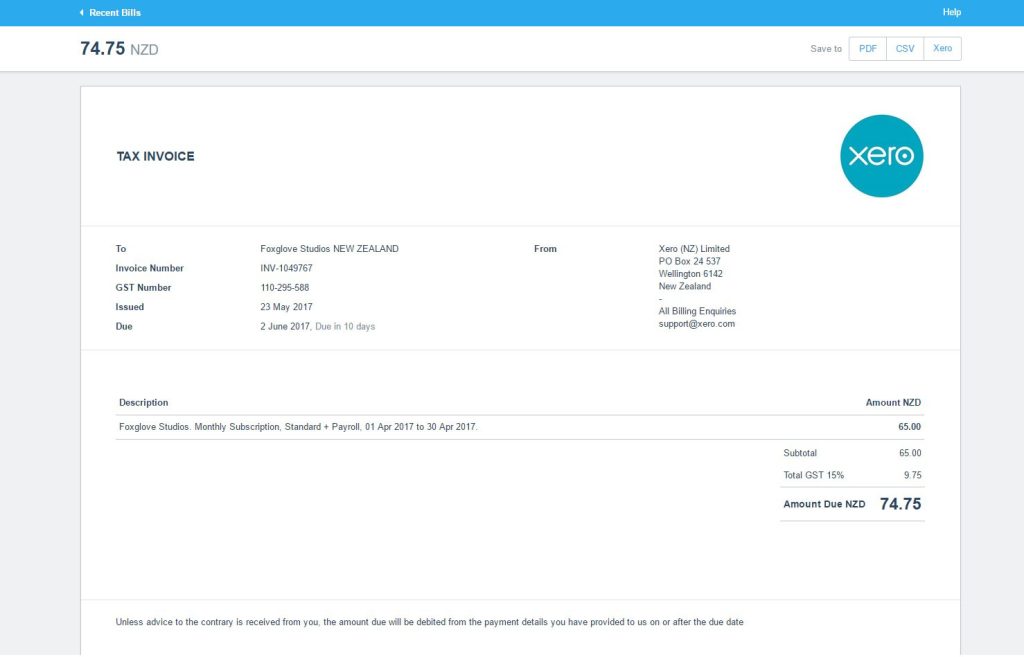

Xero

Xero is accounting software that offers unlimited users, round-the-clock support, and all the time-saving features you need to expand your business. It also takes pride in its dependability and security.

Top Features

- Set up recurring invoices.

- Automate invoice payment reminders

- Easy invoicing: create professional custom-designed invoices.

- Let your customers pay you online with a debit or credit card. Or with their PayPal account.

Cons:

- No free plan

- Limits on low-cost plans

Who should use it: Xero is ideal for growing business as it’s a pricey billing accounting software.

Pricing: From $20 user/month.

Cost, restrictions, and features that make it simpler for freelancers and small businesses to be paid for their work determine which invoicing software is best. It might be worthwhile to pay a higher monthly fee for billing software if it also includes tools for managing projects or keeping track of expenses.

Keeping a tight grip on your finances is a crucial step for small business owners and freelancers. You may make wiser, more informed plans for the future as you consider the situation of your income and expenses right now. In light of that, here are the best accounting software choices for small businesses in light of that.

Ultimately, your demands will determine which invoicing program is ideal for you. While freelancers may need affordable or free options, larger or expanding businesses may require accounting-specific software.